As the global limelight fades from President Xi Jinping’s “Belt and Road” summit, the main actors — Chinese state-owned companies — are warning about the political risks they face along the route.

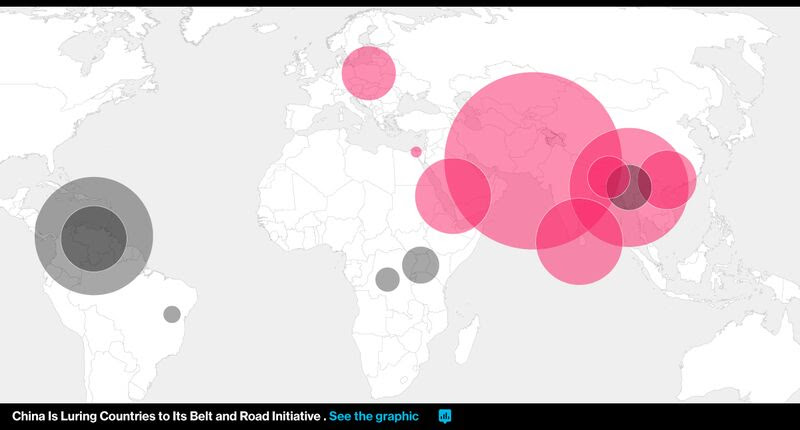

Earlier this month Xi outlined plans to direct as much as 840 billion yuan ($122 billion) to build roads, railways, ports and pipelines across Asia and beyond, securing China’s central role in world trade. The plan has the country’s state-owned enterprises weighing investments in 65 participant nations, almost two-thirds of which have sovereign debt ratings below investment grade.

“Chinese companies’ risk awareness has grown, but they still lack the ability to discern where to invest or effectively manage overseas risks,” said Yin Yili, a vice president at a unit of China Communications Construction Co., one of the nation’s largest state-owned companies. “Over these past years, we’ve paid a great price and suffered big losses. We’ve paid a large amount in tuition fees.”

The concerns highlight a major challenge of Xi’s signature trade-and-

Some 71 percent of Chinese companies said political risk topped their concerns about investing abroad, according to a survey of 300 firms published in November by the Center for China and Globalization, a Beijing-based research institution. They cited “policy changes,” “political unrest” and “government expropriation” as top worries.

Yin, who heads the industrial parks department at CCCC’s Industrial Investment Holding Co., said that almost two decades of foreign investment experience hasn’t necessarily translated into enhanced risk-control procedures for Chinese companies. Many still lack vision, negotiation skills and local knowledge, he said, adding that they sometimes assume money can solve all problems.

“A lot of times they only see a bevy of opportunities, but not pitfalls underfoot,” Yin said. “There are more than 200 countries and regions in the world, and not every place is worth investment.”

Protests, Volatility

The Belt and Road route includes volatile areas like Afghanistan and Pakistan, as well as Iraq, Syria and Yemen. African countries including Egypt, Kenya and South Africa are also on the list and scrambling to expand ties with China. Ethiopian Airlines Enterprise on Monday launched its fourth route to the country.

In 2014, protests over China’s oil-exploration in the South China Sea forced electronics maker Midea Group Co. to withdraw investment from neighboring Vietnam, which is part of the Belt and Road Initiative. China’s $1.5 billion Colombo Port City project in Sri Lanka has been dogged by demonstrations and briefly halted in 2015 after a new government pledged to review all deals by the previous Beijing-friendly administration.

Concerns about political risk were scarcely mentioned as Xi hosted almost 30 world leaders in Beijing on May 14-15. The president’s keynote address only referenced the need to manage broad financial risks, while the chairman of China’s State-owned Assets Supervision and Administration Commission told reporters that political and security threats were “completely controllable.”

‘Unstable Governments’

“China needs to not only worry about walking into political traps leading to investment loss, but also worry about security of staff and assets,” said Raffaello Pantucci, director of international security studies at the Royal United Services Institute. “You are looking at parts of the world where you have politically risky and unstable governments, a variety of security threats, and a government in Beijing which has little clear skill or experience in managing these problems.”

Risks were building long before Xi first outlined in 2013 the plan to recreate ancient Silk Road trading routes between Asia and Europe by land and sea. Beijing has been encouraging state companies to “go out” since the late 1990s, with much of that investment going toward oil and other raw materials in countries such as Venezuela, where slumping commodity prices have helped weaken the Beijing-friendly

More than $250 billion in China’s overseas investments failed between 2005 and 2015, according to the China Global Investment Tracker, a database maintained by the American Enterprise Institute and the Heritage Foundation. The Center for China and Globalization, which separately analyzed 120 unsuccessful investments, found that political factors accounted for a quarter of all cases.

Risk Insurance

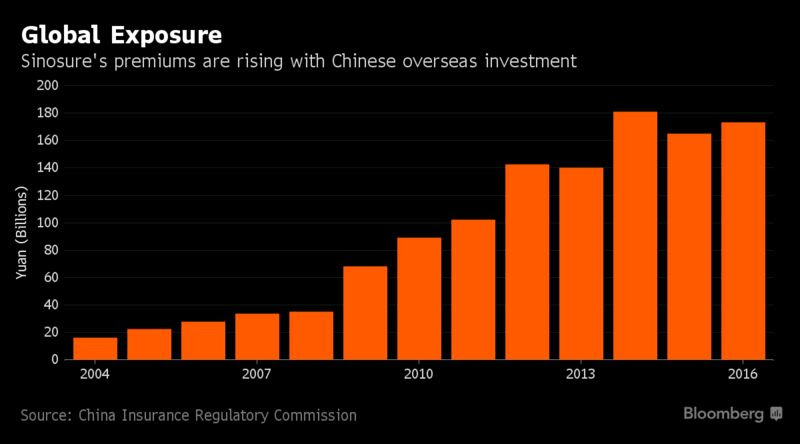

Such overseas investments are insured by the state-owned China Export & Credit Insurance Corp., or Sinosure, which covers government seizures, nationalization, political violence, contract breaches and payment delays because of political events. In an article published on the company’s website this month, Chairman Wang Yi described Sinosure as the Belt and Road Initiative’s “chief brake.”

Since 2013, Sinosure insured $440 billion of exports and investments in Belt and Road countries and paid out $1.7 billion in claims, Wang wrote. Projects insured included a 1,800 kilometer (1,100 mile) pipeline to Turkmenistan, a $1.6 billion power plant in Jordan and an $800 million dam in Cambodia.

Yuan Li, chairman of China Civil Engineering Construction Corp., which has more than 50 projects in Africa, said Sinosure’s insurance covers “extreme circumstances” like coups and war, but not normal political reversals.

“There is a change of government almost every month,” Yuan said by phone. “There is no insurance on the earth catering to that. Our policy is to make friends as widely as possible, and not to get closer to any one party than the others.”

Political concerns have led China’s state companies to steer clear of some markets. Gordon Li, the overseas business director for China Merchants Group’s international business department, said the company hasn’t considered adding India to the 48 port projects it’s financing in 18 Belt and Road countries.

“For us, the No. 1 consideration is political risk,” Li said. “It’s extremely important whether the destination countries have good relations with China or not.”